Why Everyone Should Think About Investing and why investing is important. Investing is about planning for the future, making your money work for you, and reaping the benefits of compound growth. If you are on the fence about investing or know someone who is, here’s why it’s such an important strategy for long-term financial health.

Table of Contents

1. Why Investing is Important

1.1 Inflation Impacts Savings

1.1a Understanding Inflation

At its essence, inflation represents the rising costs of goods and services over time, causing each unit of currency to buy fewer goods and services. In simpler terms, as time progresses, your money loses its purchasing strength.

1.1b The Reality of Shrinking Savings

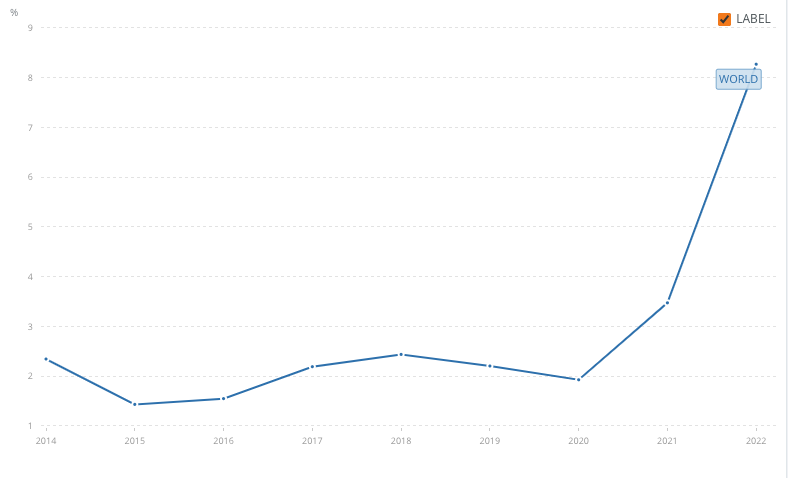

Consider a scenario where you’ve saved a substantial sum in your savings account, thinking it’ll grow over time. However, with the global average inflation rate fluctuating between 2-4%, this isn’t the case. For instance, if you saved $10,000 today and the inflation rate stands at 3%, a year from now, the real value of your money would be reduced to about $9,700 in today’s terms.

1.1c Investing as a Countermeasure

While traditional savings methods might not offer protection against inflation, certain investments can. Stocks, bonds, and real estate, for instance, have historically provided returns that not only match but often exceed inflation rates. Therefore, investing strategically can not only safeguard your savings from the corrosive effects of inflation but also potentially amplify its real value.

1.2 Security for the Future: More Than Just Today’s Peace of Mind

1.2a The Uncertainties of Tomorrow

Financial stability today does not guarantee the same for tomorrow. Life is riddled with uncertainties, from market crashes to personal emergencies. And while the present might be prosperous, what ensures that the future remains equally, if not more, secure?

1.2b The Role of Investments in Ensuring Future Stability

Investing acts as a long-term strategy to build wealth and create a financial buffer. Think of it as a parachute: while you hope never to use it, having one provides a sense of security. Retirement, for instance, is a phase when regular income ceases for most. Investments made today can morph into significant assets tomorrow, offering support when regular paychecks stop. Moreover, in case of unforeseen circumstances such as medical emergencies, a well-curated investment portfolio can prevent financial derailment.

1.3 Achieving Financial Goals: Not Just Dreams, But Tangible Realities

1.3a The Aspirations of Life

Throughout life, there are milestones we all aspire to achieve. It might be owning a dream home, pursuing higher education from a reputed institution, or taking that once-in-a-lifetime trip around the world. These aren’t just dreams but tangible goals, achievable with the right financial strategy.

1.3b Investments as Stepping Stones

While saving is crucial, it often falls short of accumulating the substantial funds required for such milestones. Investing, on the other hand, offers the potential for accelerated growth of wealth. With a myriad of investment vehicles available, from equity and mutual funds to real estate and fixed deposits, one can strategically channel funds to align with specific goals. By understanding the time frame and the amount required, investments can be tailored to ensure that when the time comes, the financial aspect isn’t a constraint.

2. Understanding the Magic of Compound Growth

2.1 Compound growth,

Also known as compound interest in financial circles, is the process by which the value of an investment grows because you earn interest on both the amount you initially invested, known as the principal and any interest, dividends, or capital gains that accumulate over time.

2.2 The ‘Snowball’ Analogy

Imagine rolling a small snowball down a snowy hill. As the snowball rolls, it gathers more snow, growing larger and gaining momentum. This is the essence of compound growth: just as the snowball grows in size and speed, your investment grows in value at an accelerating rate.

2.3 The Power of Time

Let me give you an example: If you invest $1,000 at a 5% compounded yearly interest rate, you will gain $50 in interest after the first year, bringing your total to $1,050. The next year, you’d get 5% on the entire $1,050, not just the initial $1,000. This change might be astounding over a lengthy period of time. This phenomenon emphasises the necessity of getting started as soon as possible; the longer your money is invested, the higher the compounding benefits.

2.4 Relevance in Investment

It’s not just bank interest where compounding comes into play. Reinvested dividends in stock portfolios, growth in real estate values, or any investment where the returns are reinvested can leverage the power of compound growth. The magic truly unfolds when, over long periods, even modestly sized investments can grow into substantial sums.

3. Diversifying Sources of Income: Spreading Your Wings for Financial Stability

3.1 The Risk of a Single Income Stream

In an unpredictable world, relying solely on one’s monthly salary can be a gamble. Economic downturns, industry disruptions, or personal setbacks, such as health issues, can disrupt that sole income stream, leading to financial instability.

3.2 Broadening Financial Horizons with Investments

Investments serve as an avenue to diversify income sources. By putting money in different assets, you create multiple channels of potential revenue. For instance:

Dividend Stocks: These are shares in companies that return a portion of their profits to shareholders in the form of dividends. By holding such stocks, you can receive regular payouts, creating a secondary income stream.

Rental Properties: Real estate, when rented out, can provide a consistent monthly income. Over time, as the property appreciates, it might also offer significant capital gains.

Bonds: These debt securities pay interest over a specified period and return the principal amount at maturity. They can be a steady source of interest income.

P2P Lending: Platforms that allow you to lend money to individuals or small businesses in exchange for potential interest payments can be another source of income.

3.3 The Buffer Against Uncertainties

By having multiple income streams, you’re better positioned to handle economic or personal financial challenges. If one source faces a downturn, others might remain stable or even flourish, ensuring continuous financial inflow. In essence, diversification is not just about enhancing wealth but also about safeguarding it.

In the intricate dance of financial planning, understanding the rhythm of compound growth and the stability offered by diversified income sources is essential. They represent the proactive steps one takes today to ensure a harmonious financial future.

4. The Cost of Missed Opportunities: The Consequences of Staying on the Sidelines

4.1 Understanding Opportunity Cost in Investing

Every choice we make comes with an associated opportunity cost – the value of the next best alternative that’s forgone. In the world of finance and investment, this cost becomes significantly palpable, often measured in tangible monetary terms.

4.2 Losing Out on Potential Market Gains

Riding the Market Wave: Historical data shows that, over long durations, markets have a general trend of growth. While there are downturns and recessions, they are typically followed by recoveries. By not investing, you forgo the potential to ride this wave of growth and benefit from the upward trends.

The Influence of Historical Returns: Consider the stock market. In terms of long-term returns, equities have historically outperformed other investment vehicles. By staying out of the market, you miss out on these potential profits, which may be significant over long periods of time.

4.3 The Erosion of Savings by Inflation

The Invisible Tax: Inflation, often dubbed the “invisible tax,” continually erodes the purchasing power of money. A dollar today is worth more than a dollar tomorrow. So, while your savings might seem to remain constant in nominal terms, its real value – what it can buy – diminishes over time.

The Dwindling Power of Money: Consider that a loaf of bread costing $2 today might cost $2.50 a few years from now due to inflation. If your money isn’t growing at a rate that at least matches inflation, you’re effectively losing wealth. Investing offers a shield against this erosion, allowing your money to grow and combat inflationary pressures.

4.4 The Extended Journey to Wealth Accumulation

Building Wealth: Investing is a proven avenue to accumulate wealth over time. This isn’t just about affluence but about achieving financial goals, securing retirement, and ensuring financial stability.

The Work Conundrum: Without the cushion of investment returns, one might find themselves having to work for more extended periods or take on additional jobs to meet financial needs. This can affect the quality of life, deprive one of leisure time in their later years, and add undue stress.

Lost Time Equals Lost Money: In the realm of investing, time is an ally. The earlier one starts, the more one can harness the power of compound growth, meaning smaller initial investments can lead to substantial future returns. Delaying or avoiding investing altogether means losing this ally, requiring much more significant investments later on to achieve the same financial outcomes.

The decision not to invest has a number of unanticipated repercussions. Aside from the obvious loss of prospective wages, it’s a road that can lead to future financial insecurity, higher stress, and a lower quality of life. Recognising the monetary and intangible costs of lost opportunities is critical for comprehensive financial planning and personal well-being.

5. Charting the Investment Journey: Where to Begin and Why?

The investing landscape is enormous, brimming with alternatives to meet a wide range of financial objectives and risk tolerances. However, for a beginner, traversing this vastness might be intimidating. To make things easier, let’s take a closer look at some of the most often recognised investment instruments.

5.1 Stocks & Mutual Funds

- Nature of Investment: Stocks represent ownership in a company. When you buy a stock, you own a piece of the company and, as such, have a claim on a portion of its assets and earnings. Mutual funds, on the other hand, pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities.

- Risk & Returns: Historically, stocks have offered high returns, making them attractive for wealth accumulation. But they come with volatility. Mutual funds, especially diversified ones, spread out this risk by investing in a range of assets.

- Ideal For: Investors seeking growth and who are comfortable with market fluctuations. Those wanting a hands-off approach might prefer mutual funds managed by professionals.

5.2 Bonds

- Nature of Investment: Bonds are debt securities, essentially loaning money to entities like governments or corporations. In return, these entities promise to pay periodic interest and return the principal amount at maturity.

- Risk & Returns: Generally, bonds are considered less risky than stocks. The trade-off is that their returns are often lower. However, they provide predictable income and are less susceptible to market volatility.

- Ideal For: Conservative investors seeking stable income and capital preservation.

5.3 Real Estate

- Nature of Investment: Real estate involves purchasing physical property, be it residential, commercial, or land. It’s a tangible asset that you can see and touch.

- Risk & Returns: Real estate often appreciates over time, providing potential for capital gains. It can also generate rental income. However, it requires significant initial capital and can be illiquid.

- Ideal For: Investors seeking long-term appreciation, tangible assets, and potential passive income.

5.4 Retirement Accounts

- Nature of Investment: These are special tax-advantaged accounts designed to encourage long-term savings for retirement. They might contain stocks, bonds, mutual funds, or other assets.

- Risk & Returns: Depends on the underlying assets within the account. The primary advantage is the tax benefit, allowing for potentially higher net returns.

- Ideal For: Almost everyone! Especially those planning for retirement and looking to maximize tax advantages.

5.5 Emerging Technologies

- Nature of Investment: This involves putting money into sectors at the forefront of technological or scientific advancements, like renewable energy, artificial intelligence, or biotech.

- Risk & Returns: These sectors can be high-reward due to rapid growth but come with elevated risk given their nascent stage and market unpredictability.

- Ideal For: Investors with a high-risk tolerance, looking for potential high growth and interested in futuristic sectors.

Embarking on the investment journey is not about jumping onto the trendiest option but discerning what aligns with your financial goals, risk appetite, and investment horizon. Whether you’re risk-averse or an aggressive investor, the array of choices ensures there’s something for everyone. The key lies in research, consultation, and sometimes, a bit of intuition.

Conclusion

“The journey of a thousand miles begins with a single step,” says an old saying. That stage is the decision to invest in the areas of financial progress and independence. The possibility for massive development and security may be found in the maze of options, from the stock market’s exhilarating highs and lows to the steady pace of bonds and the hopeful vistas of future technology. However, the core of investment is more than just collecting wealth; it is about constructing a future, protecting one’s goals, and leaving a legacy. For those on the fence, keep in mind that time does not return. Every day that is not invested is a day when potential growth is lost. Anyone with knowledge, dedication, and a dash of grit may flip the pages of this investing voyage and write their own story of financial achievement. So, while you stand at this crossroads, ask yourself, “Do I watch the parade go by or do I join the march towards a brighter financial horizon?” As always, the decision is entirely yours.

FAQ

Why do people invest?

Individuals invest for various reasons. Preserving and increasing wealth, protecting their financial future, especially after retirement, attaining specific financial goals like property ownership or paying for school, and generating more income are the main drivers. Additionally, investing enables people to protect themselves from unplanned financial calamities.

How should I invest to make money?

Understanding your financial goals and risk tolerance is a vital first step in learning how to generate money through investments. Diversifying your portfolio, researching before investing, leveraging tax-advantaged accounts, and considering long-term strategies rather than seeking quick profits are some effective approaches. Regularly reviewing and adjusting your portfolio based on market conditions and personal circumstances can also optimize returns.

What are the types of investing strategies?

Investing strategies vary based on goals, risk appetite, and investment horizon. Some common strategies include growth investing (focusing on assets expected to grow at an above-average rate), value investing (seeking undervalued assets), income investing (prioritizing regular income, e.g., dividends or bond yields), and diversified investing (spreading investments across various assets to manage risk).

What are some small investments that make money?

Small investments can still yield decent returns. Examples include dividend-paying stocks, peer-to-peer lending platforms, robo-advisors, investing in mutual funds with a low minimum requirement, purchasing fractional shares, or even starting with micro-investing apps that round up your daily purchases and invest the spare change.

Can you break down the basics of investment?

At its core, investing is about allocating money in assets with the hope of generating a profit over time. It’s essential to understand some fundamental concepts:

Assets: What you invest in, e.g., stocks, bonds, real estate.

Risk vs. Reward: Typically, higher potential returns come with higher risks.

Diversification: Spreading investments to manage risks.

Compound Growth: Earning returns on both your principal and its accumulated returns.

Liquidity: How easily an investment can be converted into cash.

Time Horizon: The expected duration before you’ll need to cash out an investment.