IN THIS ARTICLE

Identification of Subscriptions: Check your bank statements and use tracking apps to list all your subscriptions.

Categorise: Divide these transactions into essentials, non-essentials, and luxuries.

Evaluate: Consider how often you use each service and its value to you.

Budget Impact: Look at how subscriptions affect your finances and identify overspending.

Cancel: Prioritise cancellations based on usage/value, follow cancellation steps, and get confirmation.

Post-Cancellation: Set a subscription budget, decide what to do with saved money, and be cautious with new subscriptions.

Regular Checks: Periodically review your subscriptions to keep them in check.

Negotiate: Don’t be shy to haggle for better rates on essential subscriptions.

Alternatives: Explore free resources and consider one-time purchases over subscriptions.

Share Your Success: Inspire others by sharing your journey and savings from the challenge.

Table of Contents

Introduction: The Subscriptions Cancellation Challenge

Are you up for a challenge? It’s not your usual kind. It’s about money, but it’s also about making choices. We’re diving into a world where every little tap can add up to a big chunk of your cash. Yes, we’re talking about subscriptions – those sneaky little things that seem small but can gobble up your funds without you realising it.

Imagine this: You’ve got your gym membership, that app you downloaded for fun, and the streaming services you can’t live without. They’re all part of your daily life. But do you know how much they’re really costing you? It’s time to find out. The Subscriptions Cancellation Challenge is all about taking control, looking at what you’re paying for, and asking yourself, “Do I really need this?”

The beauty of this challenge lies in its simplicity and the profound impact it can have on your finances. By evaluating and ditching the subs you don’t need, you could be saving a small fortune. And who doesn’t like the sound of extra money in their pocket?

Part 1: Understanding Your Subscription Landscape

Identifying All Subscriptions

First up, let’s play detective. Gather all your subscriptions, both digital and physical. These could be magazines, online services, apps, or membership clubs. To spot them all, dig into your bank statements and look for regular payments. Don’t forget to check your emails for any digital receipts or subscription confirmations. It’s a bit like a treasure hunt, but instead of finding treasure, you’re finding costs that you can cut!

Utilising Bank Statements and Apps for Tracking

Bank statements are gold when it comes to tracking your subs. They don’t lie, and they’ll show you exactly where your money’s going. But we’re in the 21st century, right? So let’s make it even easier. There are apps out there that can help you track your subscriptions. They connect to your bank and sort out the one-offs from the regulars. It’s pretty nifty, and it means you won’t miss anything.

Categorising Subscriptions

Now you’ve got your list, it’s time to sort them out. Essentials are things like your electricity or your internet. Non-essentials? Maybe that’s the magazine you love but could live without. Luxuries are the ones that are nice to have but are not really necessary, like that premium coffee club. Understanding what each subscription offers you in terms of usage and joy is key. If you’re not using it or it doesn’t make you smile, why keep it?

Part 2: Evaluating Subscription Worth

Analyzing Usage and Value

Think about how often you use each service. Is that fitness app just sitting there, or is it helping you become the next superstar athlete? Weigh the joy or benefits you get against the cost. If the scales tip towards “not worth it,” it’s probably time to say goodbye.

Impact on Budget

Now, let’s talk about your budget. These little subs can be sneaky, creeping up on your monthly spend without you noticing. But when you add them up over a year, they can make a big dent. By identifying where you’re overspending, you can redirect that money to something more rewarding – like saving for a holiday or building an emergency fund.

This is just the beginning of our journey. By taking on this challenge, you’re taking the first step towards a wallet that’s a bit fuller and a life that’s clutter-free from unnecessary commitments. Are you ready to dive in?

Part 3: The Cancellation Process

Prioritising Subscriptions for Cancellation

Now that you know what you’re dealing with, it’s time to make some decisions. Which subscriptions are going to get the chop? It’s a bit like a talent show where you’re the judge. You’ve got to be firm but fair. Look at each subscription and ask yourself, “How much am I using this? Is it giving me enough bang for my buck?” If it’s not, then it might be time to hit the cancel button. The less you use it and the less value it provides, the higher it should be on your “to cancel” list.

Step-by-Step Cancellation Guide

Ready to cancel? Here’s how to do it:

Find the Cancellation Option: Sometimes it’s easy, and there’s a big ‘Cancel Subscription’ button. Other times, it’s like they’ve hidden it in a maze. You might need to dig around in the settings or account section of the service.

Check the Terms: Before you cancel, check if there’s a notice period or a cancellation fee. You don’t want to be caught out and end up paying more.

Follow the Steps: Go through the cancellation process. Take your time and read everything before you confirm.

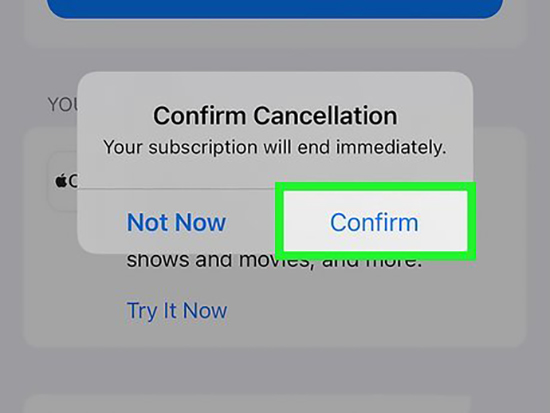

Get Confirmation: Once you’ve cancelled, make sure you get a confirmation email or message. If you don’t get it, follow up. It’s your proof if there are any disputes later.

Remove Payment Methods: If possible, remove your payment details from the account so there’s no chance of a surprise charge later.

Keep a Record: Make a note of when you cancelled and any confirmation numbers. It’s good practice to keep track, just in case.

Handling Cancellation Fees or Contracts

Sometimes, you might face a fee to cancel, or you’re in a contract. Weigh the cost of the fee against the remaining cost of the subscription. If it’s cheaper to pay the fee and cancel, then it might be worth it. If you’re in a contract, mark your calendar for when it ends and decide if you want to renew or not.

Part 4: Managing Subscriptions Post-Challenge

Creating a Subscription Budget

Now that you’ve cleared out the clutter, keep it that way. Set yourself a subscription budget. It’s like giving yourself a pocket money limit. How much do you want to spend on subscriptions each month? Stick to it, and you’ll avoid subscription overload.

Allocating Funds Saved from Cancellations

Here’s the fun part. Decide what to do with the money you’ve saved. Maybe start a savings account or put it towards something special. It’s your reward for being so savvy.

Monitoring New Subscriptions

From now on, every time a new subscription tempts you, give it the third degree. Do you really need it? How does it fit into your budget? If you decide to go for it, check in with yourself after a few months. Are you using it? Is it worth it? If not, you know what to do.

Regular Reviews of Subscription Usage

Set a date, maybe every six months, to review your subscriptions. It’ll keep you in control and your budget happy. And it means you can be sure that everything you’re subscribed to is something that adds value to your life.

This is your post-challenge plan. Stick to it, and you’ll keep your finances shipshape and Bristol fashion. You’ve got this!

Part 5: Tips and Tricks

Strategies for Avoiding Unnecessary Subscriptions

The key to keeping subscriptions at bay is mindfulness. Before you click ‘subscribe’, pause. Think about whether it’s something you genuinely need or just a fleeting want. Give yourself a cooling-off period — if you still think it’s essential after a week, then maybe it’s worth considering.

Another nifty trick is to use reminder apps. Set a reminder for a week before any free trial ends. This way, you won’t accidentally roll into a paid subscription if you don’t want to continue.

Alternatives to Subscriptions

Why buy the cow if you can get the milk for free, right? For nearly every paid subscription service out there, there’s a free alternative. It might not have all the bells and whistles, but it’ll do the job. If you’re after reading material, your local library is a goldmine. For music, there are plenty of free streaming services supported by ads. And for fitness apps, YouTube is chock-full of free workout videos.

If you need a service only once in a while, consider a one-time purchase instead of a subscription. It might be more upfront, but it’ll save you money in the long run.

Negotiating Better Rates for Essential Subscriptions

Got a subscription you can’t live without? Try haggling for a better price. Reach out to customer service and ask if there are any discounts or promotions you can take advantage of. Sometimes, just the act of attempting to cancel will bring better offers out of the woodwork.

Conclusion

Let’s circle back and tie everything up with a bow. The Subscriptions Cancellation Challenge is your ticket to a leaner budget and a clearer mind. We’ve walked through identifying, evaluating, and cancelling subscriptions that don’t serve you. We’ve talked about setting a budget and keeping tabs on your subscription landscape. And we’ve shared some top tips and tricks to keep you on the straight and narrow.

Remember, the money you save here is money you can use elsewhere — for things that matter more to you. Maybe it’s a trip, maybe it’s saving for a rainy day, or perhaps it’s investing in a passion project. Whatever it is, you’re now equipped with the savvy to make it happen.

So, why not share your story? If you’ve taken the challenge and come out the other side with a win, let’s hear about it. Your success could inspire others to take control of their subscriptions and their savings. Let the sharing begin!

What is the Subscription Cancellation Challenge?

The Subscription Cancellation Challenge is a step-by-step approach to help you identify and cancel unnecessary subscriptions, potentially saving you a significant amount of money each month.

How can I track all my subscriptions?

You can track your subscriptions by reviewing your bank statements, credit card statements, and using subscription tracking apps to identify recurring charges.

What should I consider before cancelling a subscription?

Before cancelling, assess how often you use the subscription, its importance in your life, and whether the cost is justified by the value it provides. Also, check for any cancellation fees or terms in the contract.

How do I create a budget for my subscriptions?

Determine a monthly amount you’re comfortable spending on subscriptions and stick to it. Regularly review your subscriptions to ensure they fit within your budget and adjust as necessary.

What are some alternatives to paid subscriptions?

Alternatives to paid subscriptions include free resources such as public libraries, ad-supported music and video streaming services, and one-time purchases that eliminate the need for recurring payments.